How to Make Money While You Sleep? 3 Smart Strategies for Building Wealth

Introduction to Passive Wealth Creation

Let’s be honest—everyone loves the idea of waking up richer than they were the night before. “Make money while you sleep” sounds like a dream, right? But here’s the truth: it’s not magic, and it’s not luck. It’s structure, patience, and smart planning.

This article breaks down a proven, practical approach—often referred to as the Walia Method—that focuses on building wealth in layers. No hype. No shortcuts. Just solid financial logic that works quietly in the background while you live your life.

What Does “Make Money While You Sleep” Really Mean?

It doesn’t mean doing nothing forever. Think of it like planting a tree. You work hard at the beginning—digging, planting, watering. Once it’s grown, it gives shade and fruit with minimal effort.

Making money while you sleep means your money is working, not you. Investments grow, dividends roll in, assets appreciate—all without daily effort.

The Myth vs. The Reality of Passive Income

The myth:

???? Passive income is instant, effortless, and risk-free.

The reality:

???? Passive income is built, protected, and nurtured over time.

And that’s where the Walia Method shines.

Understanding the Walia Method

Why Structure Matters More Than Speed

Most people fail at building wealth because they rush. They invest without protection, chase returns, and panic when life throws a curveball.

The Walia Method flips the script. It asks one simple question first:

“What could go wrong—and how do we protect against it?”

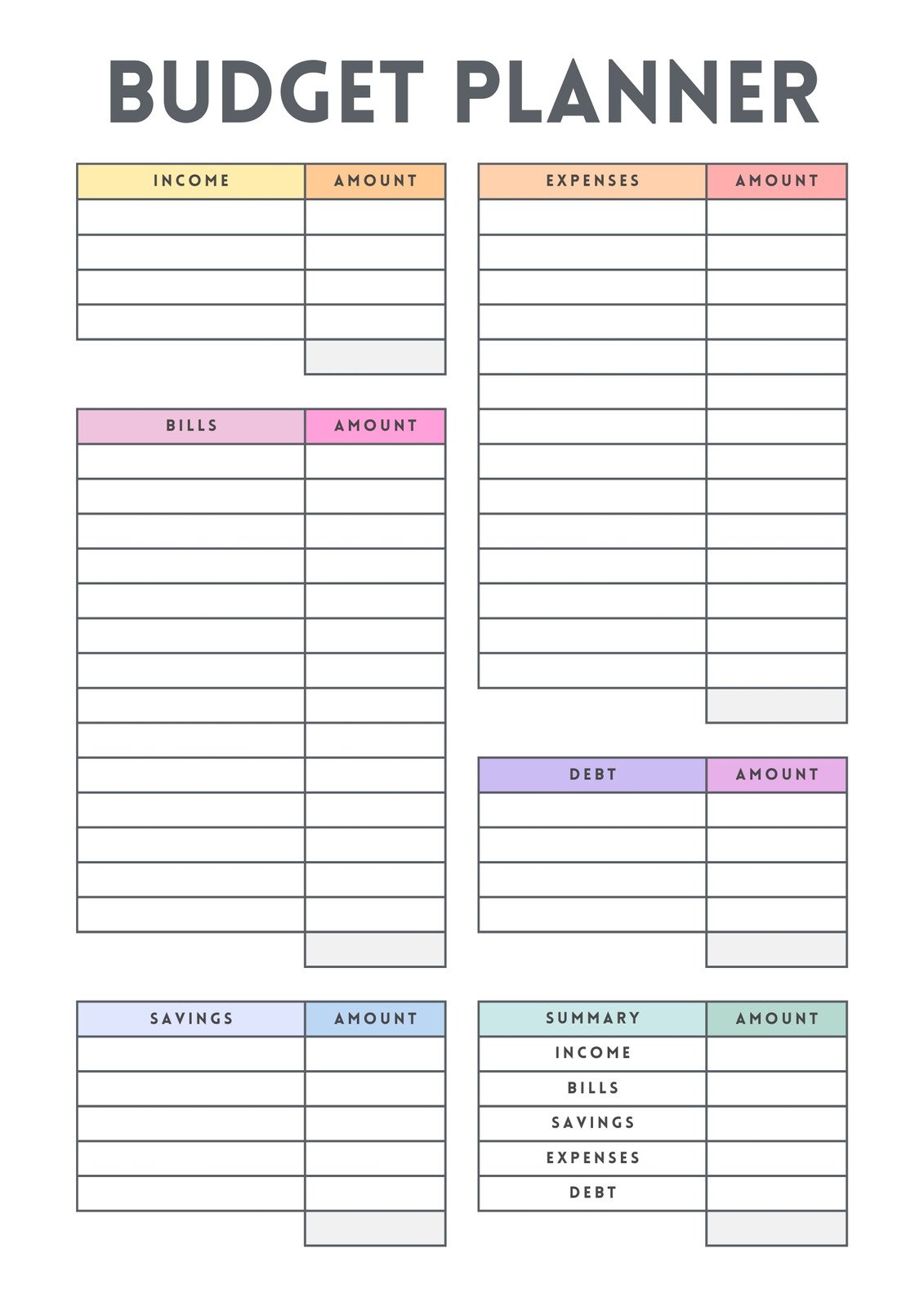

The Three-Bucket Wealth Framework

Think of your money as three separate buckets:

Safety First

This is your shield.

Lifestyle Balance

This is your joy.

Long-Term Growth

This is your legacy.

Each bucket has a job. Mixing them is where trouble starts.

Strategy 1 – The Emergency Fund (The Foundation)

What Is an Emergency Fund?

An emergency fund is money set aside for life’s “uh-oh” moments:

•Medical emergencies

•Job loss

•Urgent repairs

•Unexpected expenses

It’s not an investment. It’s insurance.

How Much Should You Save?

Financial experts recommend 6 to 12 months of living expenses.

Why? Because life doesn’t send a calendar invite before things go wrong.

Where Should You Keep Your Emergency Fund?

It must be:

•Easy to access

•Stable

•Low-risk

Liquidity vs. Returns

This is not the place to chase high returns. Liquidity beats profit here. Your money should be available immediately, not “after market hours.”

Avoiding Forced Liquidation

Forced liquidation is one of the biggest silent wealth killers.

Imagine this:

You invest in stocks. The market crashes. At the same time, you lose your job. Without an emergency fund, you’re forced to sell investments at the worst possible moment.

That’s forced liquidation—and it derails long-term wealth fast.

Real-Life Example of Emergency Fund Protection

Two investors. Same portfolio. Same returns.

One has an emergency fund. One doesn’t.

A crisis hits.

One sleeps peacefully.

The other sells assets at a loss.

Same strategy. Very different outcome.

Strategy 2 – Allocation for Short-Term Goals

Why Short-Term Goals Deserve Their Own Money

Short-term goals are exciting:

•A vacation

•A new car

•Home renovation

But funding them from long-term investments is like cutting down a fruit tree for firewood. Short-term pleasure, long-term damage.

Examples of Short-Term Financial Goals

•Buying a car in 2026

•Renovating your home in 2027

•Planning a dream trip

These goals need clarity and separation.

Best High-Liquidity Instruments for Short-Term Goals

Money Market Funds

Stable, liquid, and slightly better than cash.

High-Yield Savings Accounts

Simple, safe, and predictable.

Short-Term Bonds

Low volatility with modest returns.

How This Strategy Protects Long-Term Wealth

By separating short-term money, you avoid touching your growth assets. That means your long-term investments stay invested—and compounding continues uninterrupted.

Strategy 3 – Strategic Investment for Long-Term Wealth Growth

The Power of Compounding

Compounding is money’s superpower.

It’s not about how much you invest—it’s about how long you stay invested.

Time turns small amounts into serious wealth.

Assets That Work While You Sleep

Stocks

Ownership in businesses that grow over time.

ETFs

Diversified, low-cost, and beginner-friendly.

Real Estate

Rental income plus appreciation.

Why Long-Term Money Should Be Left Alone

This bucket is sacred.

No emergencies.

No vacations.

No impulse spending.

The less you touch it, the more powerful it becomes.

Risk Management Through Time

Time reduces risk. The longer you stay invested, the less short-term volatility matters. That’s how wealth grows quietly.

How the Three Strategies Work Together

Building a Financial Flywheel

•Emergency fund protects you

•Short-term goals keep you motivated

•Long-term investments build wealth

Each supports the other.

Peace of Mind Meets Growth

When safety and lifestyle are covered, you invest with confidence—not fear.

Emotional Discipline in Investing

Emotions ruin more portfolios than bad strategies. This system removes panic from the equation.

Common Mistakes People Make When Chasing Passive Income

Skipping the Emergency Fund

Fastest way to fail.

Mixing Short-Term and Long-Term Money

Confusion leads to bad decisions.

Expecting Overnight Results

Wealth is boring. And that’s a good thing.

How to Start Today (Simple Action Plan)

Step 1 – Assess Your Monthly Expenses

Know your number.

Step 2 – Build Buckets

Separate accounts. Separate purposes.

Step 3 – Automate Everything

Automation removes excuses.

Conclusion

Making money while you sleep isn’t about hacks or hype. It’s about designing a system that protects you, supports your life, and compounds quietly over time.

Build the foundation. Plan your joy. Let your wealth grow.

That’s how money works for you—even when you’re asleep.

11/01/2026 09:04 75

.png)