Financial independence isn’t just a buzzword anymore. As we move into 2026, it has become a survival skill, a lifestyle choice, and for many, a deeply personal mission. Market volatility, inflation concerns, and changing job dynamics have pushed people to rethink how they earn, save, and invest. The good news? Financially independent investors who’ve already walked this path are leaving behind a clear trail of lessons—and you can follow it.

Let’s break down the most powerful wealth-building advice shared by self-made investors and translate it into practical strategies you can actually use.

Why Financial Independence Still Matters Going Into 2026

Economic uncertainty and changing money habits

The past few years reshaped how people think about money. Stable jobs no longer feel permanent, markets swing faster than emotions, and traditional retirement plans seem less guaranteed. In this environment, financial independence isn’t about luxury—it’s about resilience.

The shift from survival to strategy

Many people spent years just trying to stay afloat. Now, the focus is shifting toward control. Control over time. Control over choices. Control over the future. Financial independence gives you that control.

What Financial Independence Really Means Today

Redefining freedom beyond early retirement

Forget the idea that financial independence only means retiring at 35 and sipping coconuts on a beach. Today, it’s about options. You can work because you want to, not because you have to.

Time, choice, and peace of mind as true wealth

Think of money like oxygen. You don’t notice it when you have enough—but you panic when you don’t. Financial independence ensures you can breathe easily, no matter what life throws at you.

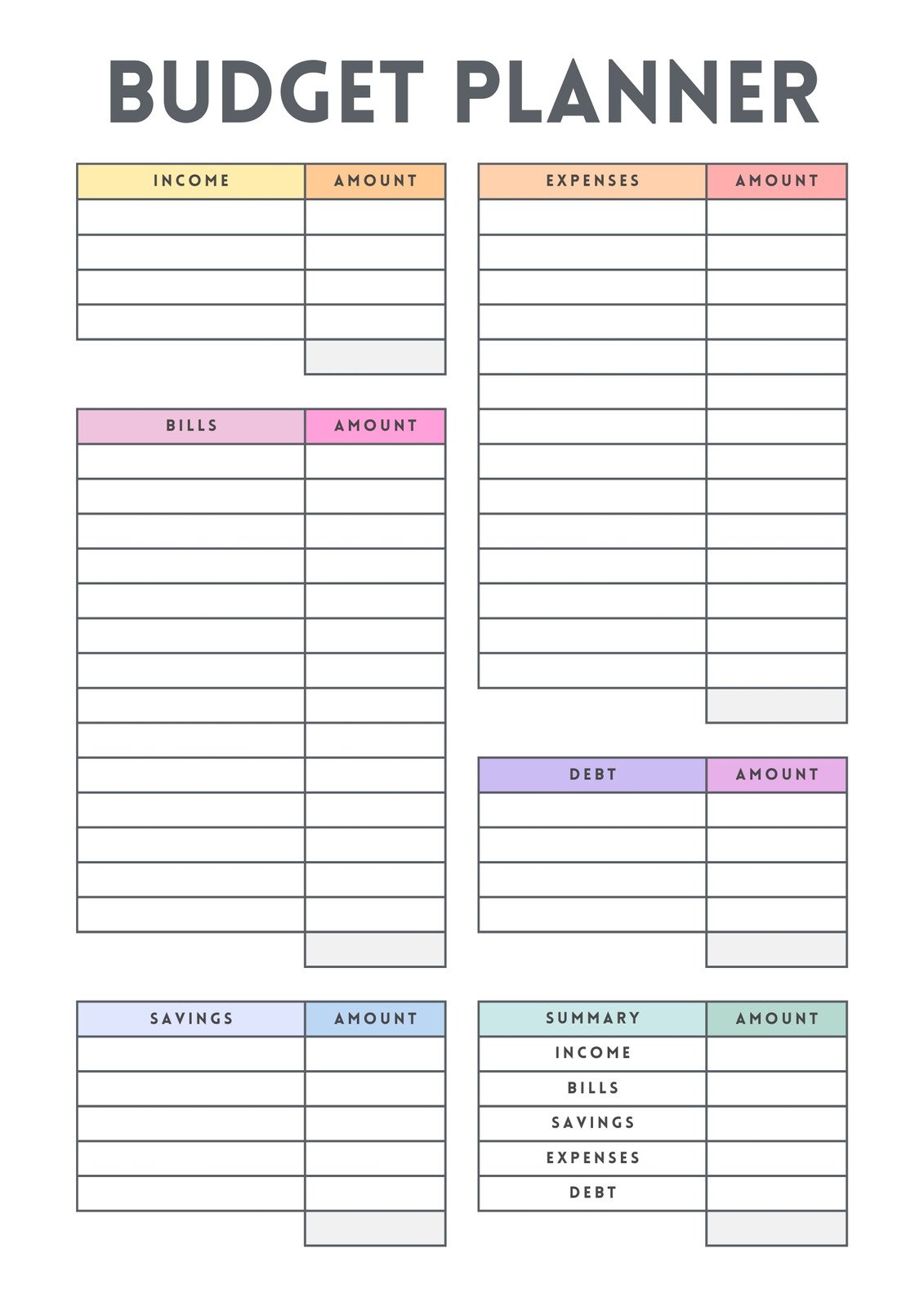

Investor Insight #1 – Know Your Numbers Before Anything Else

Why tracking net worth changes behavior

You can’t improve what you don’t measure. Tracking your net worth is like turning on the lights in a dark room. Suddenly, everything becomes clearer—your progress, your mistakes, and your opportunities.

Tools and habits for clarity

Simple spreadsheets, budgeting apps, or net-worth trackers are enough. What matters is consistency. Check in monthly, not obsessively, and use the data to guide decisions.

Setting a Clear Financial Target

The power of defining your “number”

Successful investors don’t guess. They calculate. Whether it’s retirement, Coast FIRE, or passive income goals, having a clear number gives direction to your efforts.

Coast FIRE explained in simple terms

Coast FIRE means you’ve already invested enough that, even if you stop contributing, compound growth will carry you to retirement. It’s like pushing a snowball downhill—eventually, gravity does the work.

Investor Insight #2 – Stop Obsessing Over Small Expenses

The myth of cutting coffee to build wealth

Skipping coffee won’t make you rich. That’s like trying to drain the ocean with a spoon. Small expenses matter far less than big decisions.

Why mindset beats micromanagement

Instead of stressing over every purchase, focus on income growth, savings rates, and investment strategy. Wealth grows from alignment, not anxiety.

Asking the $30,000 Questions

High-impact financial decisions

Questions like “When will I be debt-free?” or “What’s my investment rate?” move the needle. These are the decisions that shape decades, not days.

Designing your personal “rich life”

Your rich life might include travel, flexibility, or security—not luxury cars. Define it clearly, and let your money serve that vision.

Investor Insight #3 – Housing as a Wealth Accelerator

Why housing costs hold most people back

For many households, housing eats up the largest chunk of income. Left unmanaged, it slows wealth-building dramatically.

Turning your home into an income asset

Smart investors flip the script. Instead of housing being a cost, they make it a cash-flowing asset.

What Is House Hacking and Why It Works

A beginner-friendly real estate strategy

House hacking means living in a property while renting out part of it. One home. Multiple income streams. One powerful concept.

Owner-occupied financing advantages

Lower down payments and better loan terms make this strategy accessible, even for beginners. Over time, rental income can eliminate your housing payment entirely.

Investor Insight #4 – Build Multiple and Leveraged Income Streams

Active income vs leveraged income

Trading time for money has limits. Leveraged income breaks those limits by separating effort from earnings.

Why scalability matters more than hustle

Hustling harder isn’t the answer. Building systems that scale is.

Understanding One-to-Infinity Leverage

Turning effort into exponential returns

Create once. Sell endlessly. That’s the magic of digital leverage—courses, apps, subscriptions, content platforms.

Digital products, platforms, and systems

Technology allows you to reach thousands—or millions—without increasing workload. This is how modern wealth is built.

Investor Insight #5 – Provide Value First, Money Follows

Value creation as the foundation of wealth

Every wealthy person solves problems. The bigger the problem and the more people affected, the greater the reward.

Solving problems at scale

Think beyond one-on-one services. How can your knowledge, skills, or experience help many at once?

Common Traits Shared by Financially Independent Investors

Long-term thinking

They play the long game. No shortcuts. No overnight fantasies.

Discipline, patience, and adaptability

Markets change. Strategies evolve. The mindset stays strong.

Mistakes to Avoid on the Path to Financial Independence

Chasing trends instead of fundamentals

Hot investments fade. Solid principles last.

Confusing income with wealth

High income doesn’t equal wealth. What you keep and grow matters more.

How to Apply These Strategies in 2026

Simple steps you can start today

Track your net worth. Increase your savings rate. Explore leveraged income ideas. Learn before you leap.

Building momentum year by year

Wealth compounds slowly—until it doesn’t. Stay consistent and let time work for you.

The Bigger Picture – Wealth as a Tool, Not a Goal

Using money to buy freedom

Money isn’t the destination. It’s the vehicle.

Aligning finances with life values

When your money reflects your values, financial independence becomes deeply satisfying.

Conclusion

Financial independence in 2026 isn’t about luck, secret hacks, or extreme sacrifice. It’s about clarity, leverage, and intentional decisions. Track your numbers. Focus on big moves. Turn expenses into assets. Create value at scale. Do these consistently, and financial independence stops being a dream—it becomes a plan.

28/12/2025 12:03 112

.png)