Let’s be honest—money stress is exhausting. One minute you’re feeling okay, the next you’re wondering where your paycheck disappeared. If that sounds familiar, you’re not alone. The good news? 2026 can be the year you finally take control of your finances, not by doing anything extreme, but by doing a few smart things consistently.

Think of your money like a car. You don’t need a Ferrari to get where you’re going—you just need a reliable engine, a map, and enough fuel. Let’s break it down.

Why 2026 Is the Year to Get Serious About Your Money

The New Financial Reality

Prices are rising, digital payments are everywhere, and income streams look very different than they did a decade ago. In 2026, financial success isn’t about working harder—it’s about working smarter with your money.

Common Money Mistakes Holding People Back

Most people don’t fail financially because they’re careless. They fail because they:

•Don’t track spending

•Rely on debt for lifestyle upgrades

•Avoid investing out of fear

•Never increase their income intentionally

Sound familiar? Let’s fix that.

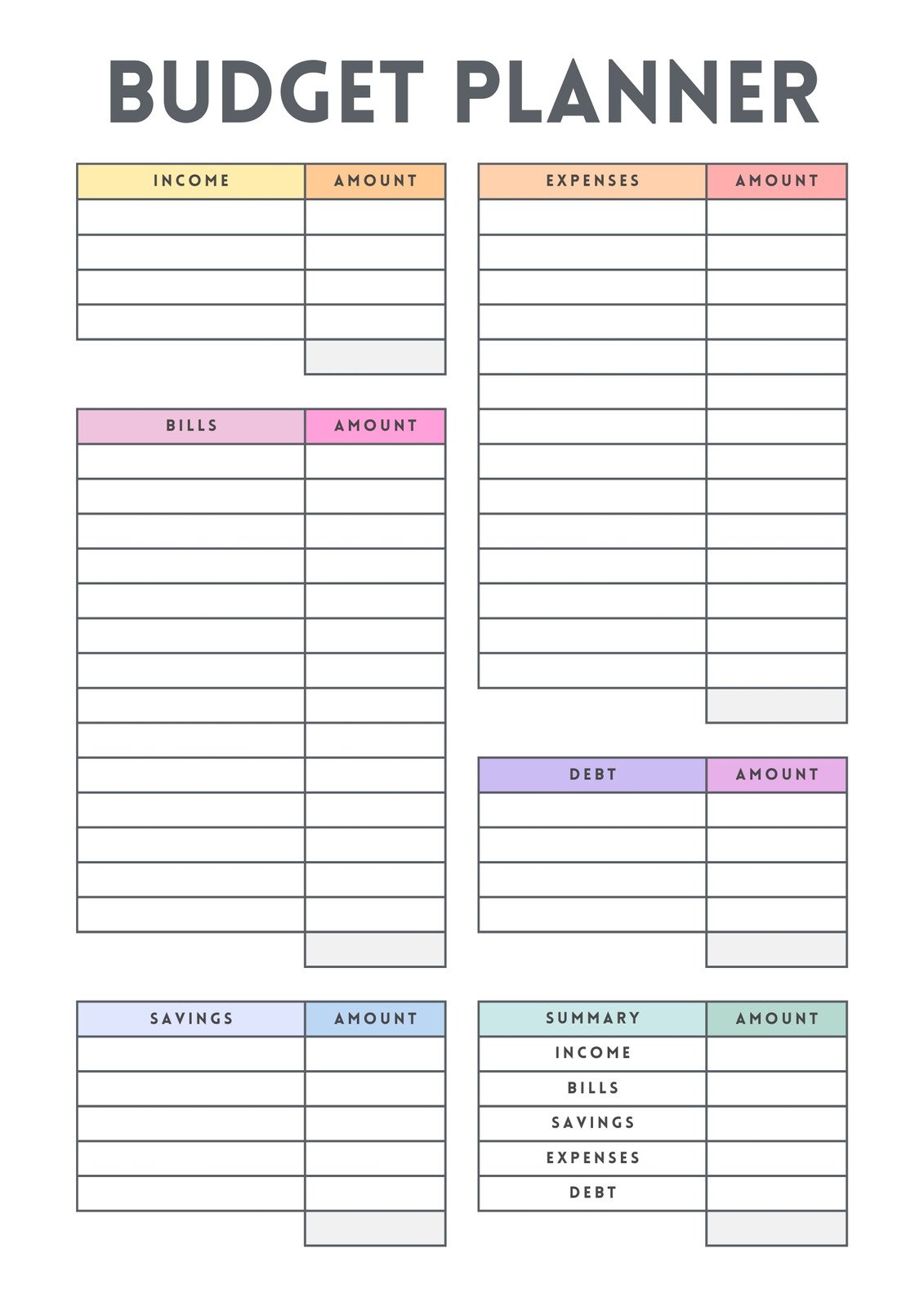

Tip 1 – Build a Simple, Flexible Budget That Actually Works

Why Traditional Budgets Fail

Old-school budgets feel like financial prison. Too strict, too detailed, and impossible to maintain. A good budget should feel like a guideline, not a punishment.

The 50/30/20 Rule (Modern Version)

Needs

Housing, food, utilities, transport—your survival basics.

Wants

Subscriptions, eating out, travel, fun stuff. Life is meant to be enjoyed.

Future You

Savings, investing, debt repayment. This is where freedom lives.

Adjust the percentages if needed. The goal is clarity, not perfection.

Budgeting Tools for 2026

Use apps or spreadsheets that update in real time. Automation beats memory every time.

Tip 2 – Automate Your Savings Like a Pro

Why Automation Is a Game-Changer

If saving depends on willpower, it won’t last. Automation turns saving into a habit you don’t think about—like brushing your teeth.

How Much Should You Save?

Start with 10%. Even 5% is powerful if you’re consistent. Increase it whenever your income grows.

Emergency Fund Essentials

Aim for 3–6 months of living expenses. This fund is your financial seatbelt—it protects you when life hits the brakes.

Tip 3 – Kill Bad Debt and Use Smart Debt Strategically

Good Debt vs Bad Debt

Bad debt drains you (credit cards, high-interest loans).

Good debt can build wealth (education, business, property—when done wisely).

The Snowball vs Avalanche Method

•Snowball: Pay smallest debts first for motivation.

•Avalanche: Pay highest interest first to save money.

Pick the one you’ll actually stick with.

Credit Score Power Moves for 2026

Pay on time, keep balances low, and don’t open unnecessary accounts. A strong credit score is like a financial passport.

Tip 4 – Make Your Money Work for You Through Smart Investing

Why Waiting Is Costly

Time is more powerful than money. The earlier you invest, the harder compound growth works for you—like a snowball rolling downhill.

Beginner-Friendly Investment Options

Index Funds

Low-cost, diversified, and perfect for long-term growth.

ETFs

Flexible, simple, and accessible for beginners.

Robo-Advisors

Hands-off investing powered by algorithms—great if you want simplicity.

Risk Management Basics

Never invest money you’ll need soon. Diversify, stay patient, and ignore short-term noise.

Tip 5 – Increase Your Income Without Burning Out

Skill-Based Income Streams

Learn a high-value skill: digital marketing, design, writing, automation, or consulting. Skills are assets no one can take away.

Passive vs Semi-Passive Income

True passive income is rare. Aim for semi-passive streams that pay you repeatedly after setup.

Using AI and Digital Tools to Earn More

AI can help you work faster, sell smarter, and scale income without working longer hours. Think leverage, not hustle.

Smart Financial Habits to Maintain Long-Term Control

Monthly Money Check-Ins

Once a month, review spending, savings, and goals. No judgment—just awareness.

Mindset Shifts for Wealth Building

Stop thinking “I can’t afford it.”

Start asking “How can I afford it responsibly?”

Common Financial Myths to Ignore in 2026

“You Need to Be Rich to Invest”

False. You need consistency, not a big bank balance.

“Saving Is Enough”

Saving protects you. Investing grows you. You need both.

How to Create Your 2026 Personal Money Plan

Setting Clear Financial Goals

Short-term, mid-term, and long-term. Give your money a job.

Tracking Progress Without Stress

Progress beats perfection. Adjust as life changes.

The Role of Financial Education in Modern Wealth

Learning From the Right Sources

Books, credible creators, and real-world case studies—not hype.

Avoiding Get-Rich-Quick Traps

If it sounds too good to be true, it usually is. Wealth is built, not hacked.

Final Thoughts on Taking Control of Your Finances

Taking control of your finances in 2026 isn’t about cutting joy or living in fear. It’s about confidence. Confidence to handle emergencies. Confidence to invest in yourself. Confidence to say yes—or no—without stress. Start small, stay consistent, and let momentum do the heavy lifting.

22/12/2025 10:36 141

.png)